The financial sector is diverse. A borrower can apply for money lenders for a range of services. Loans are the most popular among them. Despite the fact that everyone knows that it isn’t difficult to get a loan from lenders, not everyone understands what revolving credit is. Due to it, we should get a closer look into the revolving line of credit to increase the overall level of financial education. So, here we go!

Revolving Credit Definition

Source:youtube.com

A revolving loan is a loan for replenishing the working capital without collateral. It is usually taken for a short period of time in order to invest money and then quickly return it back.

To understand this notion better we should consider the revolving credit examples. Such credits can be suitable for trading business purposes. It is extremely popular for purchasing goods and reselling them lately. In this way, revolving credit is applied to afford great money investments, purchase materials, and manufacture products.

Among other things, such loans are beneficial for all business areas to launch a marketing campaign, sell more, and consequently earn more.

What Is A Revolving Line of Credit?

Revolving line of credit – it is when the bank gives you a certain amount of money for the period specified in the contract. You can spend money from this limit, return it back and use it again, just like with a credit card. As a rule, you can use the money six months before the end of the contract in order to have time to pay off the debt in the remaining time.

What Should You Focus on Before Taking a Revolving Credit?

Source:bankcheckingsavings.com

Before you apply to a banking establishment or such alternative lenders as Trice Loans, think whether the revolving loan is a great option for you. If you don’t have a particular strategy on how to pay the money back, revolving credit isn’t for you.

However, if you are serious about applying for such financial aid, take into account a number of factors:

- Estimate how much money you have;

- Calculate the revenue you expect to receive in the coming months.

- Calculate the mandatory expenses that you have to pay back in any case. Such expenditures include rent, taxes, and wages. Set an amount for unexpected expenses: a store may flood, and suppliers may raise prices.

- Calculate how much you have to pay on the loan each month.

- Subtract all these expenses from the revenue and evaluate the potential profit. If the result satisfies you, you can take this kind of loan.

What Can You Spend Money On?

Source:pinterest.com

A revolving loan is not a targeted loan. It means that the borrowed money can be used for any business purpose. For example, to buy bicycles for the store before spring or invest in an advertising strategy to attract more customers. We do not recommend using the money of a revolving loan to buy something that will not pay off in the near future.

You should not spend them on buying a car or premises for a company. Such expenses usually do not bring quick profits and take a long period for paying off. The things are really complicated but even such calculations can help you understand whether a revolving loan is suitable for you.

Any business is constantly changing, so in addition to expenses accounting, you also need to:

- Track key business metrics in dynamics: the number of products sold or services rendered, the average number of customers you have, and the change in the average check. In such a way you will be able to track when your business is in season and consequently the demand is growing. As you can guess it will also help you define when there is a lull, no clients but a great need in reviewing costs.

- Segment your business and analyze the profitability of each direction separately. For example, if an entrepreneur sells cars, he or she can track the popularity of expensive and budget brands. Perhaps it will help to understand which direction is worth strengthening.

- The most important thing is to analyze your business based on real numbers and facts. Be realistic in your calculations. Otherwise, you can fall into a financial trap.

When It Is a Bad Idea to Take a Revolving Loan?

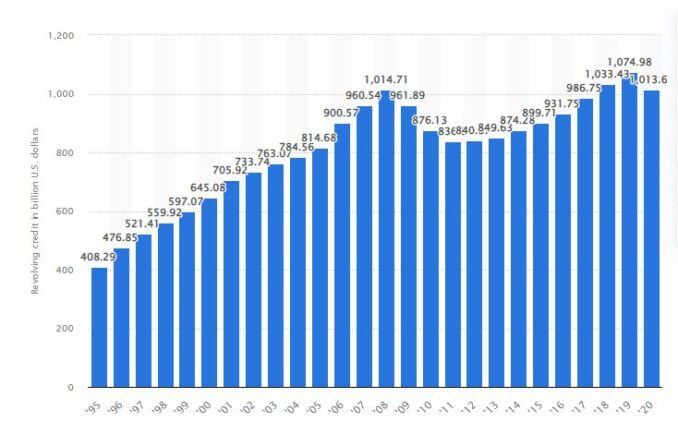

According to Statista data the value of revolving credit outstanding in the United States generally increased. It means that this topic is relevant to many people. Some borrowers may try to get this kind of loan without having a real need for it.

Now let’s consider the cases when a revolving loan will not help your business. If you are planning a large purchase this option is not for you. A revolving loan is not suitable for capital expenditures, such as the purchase of expensive equipment or the construction of a new workshop. Such investments pay off for a long time and cannot bring profit immediately.

Usually, the cost of a large purchase is broken down by the period that it will serve. This is called depreciation. With its help, the entrepreneur estimates how much you need to save in order to recoup the costs. This may take many months or years. If you are planning a great purchase, a credit line secured by real estate is suitable.

If you have already taken loans. Some entrepreneurs support their business through loans: they take one, then a second one to close the first one, and so on. After some time, the entrepreneur is denied another loan and debts begin to pile up.

Final Thoughts

For many people, a revolving credit facility can become a helping hand for opening or maintaining their business. The conditions of cooperation are usually appealing and comfortable. However, this option is not for you if you don’t have a strategy. Before applying for a loan make sure you understand whether your idea will be profitable and allow you to pay money back quickly. Without this understanding you have a risk of getting into trouble.