If you want to transfer money abroad, you’ll likely opt for a SWIFT transfer. It is the easiest way to send money to an international bank account with little hassles. The transfers are safe and reliable but aren’t always the fastest option. This article will discuss what affects the speed of a SWIFT transfer and how long you should expect yours to take.

What Is SWIFT?

It is an abbreviation for Society for Worldwide Interbank Financial Telecommunications. It is the standard communications system that global financial institutions use to send and receive instructions. Every bank connected to this network has unique digits that identify them, called a SWIFT code or Bank Identifier Code (BIC).

The SWIFT network has existed for 50 years. Virtually every bank that supports foreign transactions is connected to the network.

How Does A SWIFT Transfer Work?

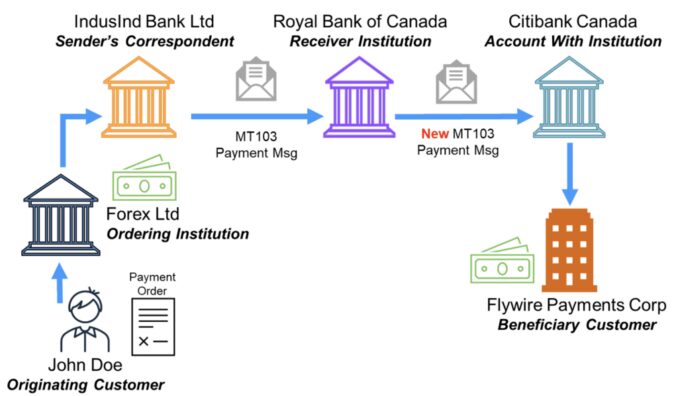

Source: alessa.com

The most important information needed for a transaction is the BIC. This code is how institutions connected to the network identify themselves.

Suppose you initiate a transfer to a foreign account. In that case, your bank will instruct the recipient’s bank via its BIC to credit the intended account with a specific amount. Once the credit is confirmed, your bank deducts the equivalent amount from your account.

It works similarly if you’re receiving a foreign transfer. The sender’s banking institution will contact your institution to credit your account with a specific amount. Once confirmed, it deducts that amount from the sender’s account.

What Does A BIC Look Like?

It consists of 8 to 11 characters in this format; AAAABBCCXXX.

- The first four characters identify the name of the financial institution.

- The next two characters indicate the country the bank is located in.

- The next two characters identify the banking provider’s main office in the country.

- The last three characters signify the specific banking branch.

You can find your required code by calling your bank, checking your bank statement, or using a SWIFT code finder website.

How Long Do SWIFT Transfers Take?

Source: perekaz24.eu

A transaction on the network generally takes 1 to 5 working days to settle. But yours may take longer for various reasons. The main factors affecting the transaction speed include:

Intermediaries

A transfer may pass through several intermediary banks before getting to the final recipient. This situation usually occurs if you send money between faraway countries, e.g., from the U.S. to Rwanda. Transfers passing through intermediaries take longer than straightforward ones.

Timing

The time you initiate a transfer affects the speed. Transactions initiated in the morning or early afternoon tend to be processed on the same day. In contrast, transactions initiated late in the day tend to be shifted to the next day for processing. This factor can add a delay of 1 or 2 days to the transaction.

If you initiate your transaction late on a Friday, it can get shifted to Monday for processing, adding a 3-day delay.

Currency Conversion

Currency conversions lengthen the period for a transaction to settle. For example, sending dollars from a US-based account to be converted into riyals in a Saudi account takes more time than sending dollars directly. This delay is expected because currency conversions require extra administrative work.

Fraud Prevention

Source: paysend.com

Every SWIFT transfer must pass through anti-money laundering checks. Some countries are flagged as high-risk by the SWIFT governing body, e.g., Ethiopia, Tunisia, Iraq, and Bosnia and Herzegovina. Transfers to high-risk countries usually take longer because of enhanced due diligence.

Conclusion

We have explained the SWIFT network, how it works, and how long you should expect your payment to take. This network is the safest and most reliable way to send or receive money from abroad, but you’ll need some patience.