The real Living Wage is an independently calculated rate of pay based on the average cost of living in the UK. Paying this rate is voluntary for employers, but choosing to do so is not only beneficial to workers and their families—it is incredibly good for business and the wider economy.

1st Formations, the UK’s leading company formation agent helps you to decide whether your company or small business should pay the real Living Wage to your employees.

What is the real Living Wage?

Source: businesswest.co.uk

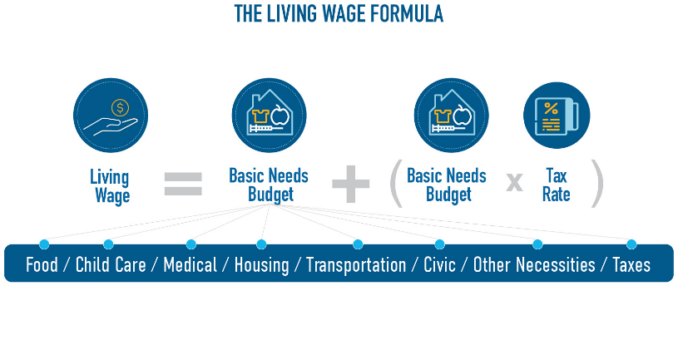

The real Living Wage is the only UK wage rate that is based on current living costs, including housing, food, essential bills, childcare, and travel costs.

It is calculated and set annually by the Living Wage Foundation – an independent, non-profit organisation that advocates a fair day’s pay for a hard day’s work.

The current rate is £10.90 an hour, uplifted to £11.95 an hour in London. It applies to all employees aged 18 and over, and it is voluntarily paid by more than 12,000 employers across the UK.

For a full-time employee working 37.5 hours a week on the real Living Wage, their annual income before tax and any other deductions will be approximately £21,255 – or around £23,302.50 if they work in London.

In contrast, the government-set National Living Wage is only £10.42 an hour, which provides an annual income of around £20,319. There is no London weighting, and the rate only applies to workers aged 23 and over. Those who are aged 16 to 22 are only entitled to the National Minimum Wage.

Amidst the rising cost of living in the UK, it is more important than ever for businesses to pay the real Living Wage to their employees. Aside from being the right thing to do, research shows that it is good for business and economic growth.

Benefits of being a Living Wage Employer

Paying staff the real Living Wage, as opposed to the lower National Living Wage or Minimum Wage, has obvious benefits for workers. But can businesses themselves benefit from paying their employees a higher hourly rate than is required by law? Yes, they most certainly can.

A CIPD report on financial wellbeing shows that concerns over money have a significant impact on employee wellbeing, job performance, and absence rates, demonstrating the business case for improving the financial health of workers.

According to a survey report undertaken by researchers at Cardiff Business School, 93% of Living Wage Employers have benefitted from accreditation, most notably in the areas outlined below.

Organisational reputation

Improvement in brand image is the most commonly reported benefit, with 86% of Living Wage Employers agreeing that accreditation ‘has enhanced the organisation’s general reputation as an employer’.

Choosing to voluntarily pay workers more than the legally required minimum shows social awareness and a commitment to improving employee wellbeing.

With 90% of consumers reporting that they are more likely to support Living Wage Employers, accreditation can be a valuable source of competitive advantage.

Human resources

Paying the Living Wage is shown to produce beneficial HR-related outcomes, ranging from higher staff morale to attracting greater numbers of skilled workers.

More than half of accredited employers have reported improvements in employee motivation and commitment, as well as better relations between staff and managers.

Similarly, more than 50% of Living Wage Employers reported improved staff recruitment and retention, whilst 45% said that accreditation raised the quality of applicants for Living Wage vacancies. Lower levels of absenteeism were also reported by a fifth of employers.

These figures demonstrate that employees are generally more satisfied in their jobs and prepared to work harder when an organisation recognises and rewards their efforts in an equitable way.

Business opportunities

Source: justcapital.com

Many clients and investors favour employers who are more socially responsible. Becoming an accredited Living Wage Employer is one of the ways in which businesses can communicate this commitment.

Between a fifth and a quarter of accredited employers reported that paying the Living Wage helped them to secure contracts with public and private sector clients, whilst over 20% stated that it helped them to secure sources of funding.

Research also shows that investment in employees is an increasingly important guiding principle for investors, with 62% stating that Living Wage Employer accreditation in particular factors into their decision making.

Thanks for reading.

With millions of UK households struggling the make ends meet in the cost of living crisis, paying the real Living wage is in everyone’s best interests.

By implementing a relatively small increase in your wage budget, you can improve the wellbeing of your lowest-paid employees, whilst simultaneously providing a whole host of benefits to your business.

If managed effectively, paying the real Living Wage could end up being cost neutral or even result in savings.